Pricing, contract and project launch

When I started working in sales for an automotive glazing supplier, I wondered why we had such a complex process (it was at least my first impression of the procedure) for the technical analysis, feasibility confirmation, cost calculation, etc. To me, a simpler and shorter/lighter process would have been enough. But a couple of months later, one of our main customers reported an issue with glass windows breaking spontaneously at the highway. Those were some of the normal products that we had manufactured and delivered. The customer, pushed by the NHTSA, started a thorough analysis of the cases, questioning the part design, requesting all manufacturing records, conformity testing, etc.

I understood then, why we dedicated so much effort for a detailed contract review process. Thanks to that process and having worked “by the book”, we did not have any major issues and could prove that the breakages were not caused either by a flaw in the design nor production problems. Conformity was confirmed and the customer and the autorities were satisfied with our systems.

As discussed in previous articles, safety is a priority in this industry. I am sure that you have heard about the known cases of failures on airbags, braking systems or tires (rollover cases) that ended either in casualties or at least in recalls; both equally bad for the carmaker and the related suppliers.

Ever since, the authorities and carmakers created new concepts and rules towards safer systems, designs, parts, controls, accountability, liability, etc.

Most of big automotive part suppliers manage all their business processes with special attention on safety and define procedures to monitor all relevant factors starting with pricing and contractual processes through project management, design and serial production. This means, they have successfully realized and addressed risks in every single phase of the product life cycle. They know that errors, omissions and even contractual voids could lead to potential losses, liability and in the worst case, to prosecution.

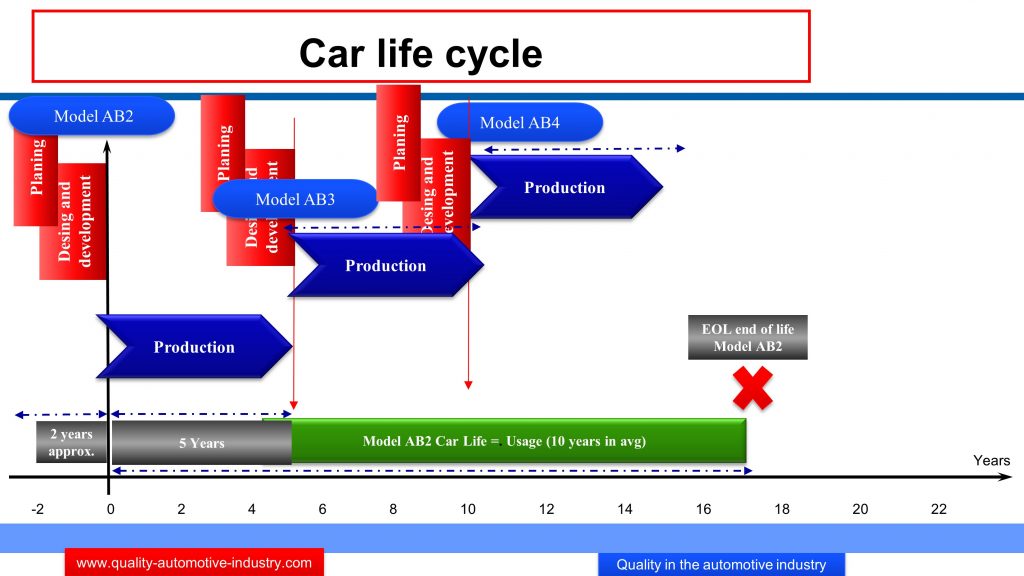

In this post we will cover the main phases of the car life cycle, in particular the processes which affect suppliers and which have an impact in the contract. For a new project these processes are known as “contract review”. But before jumping in, let me briefly describe what the carmakers define as “product life cycle” which are the phases from concept creation through the model “end of life (EOL) and cover design and development of the car, parts design, launch, manufacturing, service parts (once the serial production stops) and finally, the official life end of the car model. This cycle can be better understood with an example (please take a look at the image too -or read here the related post about APQP-).

Product life cycle.

The carmaker ABCD produces mid-size cars and SUV’s and has been very successful. The turnover has grown steadily for the last years, profit is good and the market shares in their segment are good. He has been able to identify the market needs and produces accordingly cars that make the end users happy. The strategy has been to fully analyze the market trends and needs, develop a concept for the new models and offer a full package of features and technology that makes the cars appealing and safe. The normal development process from approval through SOP (start of production) lasts two years, the normal serial production runs for 5 years and then comes exactly right after the successor with new features, appearance and packages. Today, July of year 0 (for our example), the new version of their most successful mid-size sedan (AB1) has been launched with the name AB2. During the serial production of the model AB2 the development process of the AB3 takes place so that when the AB2 reaches the time to stop being produced, the AB3 is launched with the minimal necessary transition to keep cars selling as much as possible .

Risks in the sales processes

Every company in this industry has a common goal: to make profit. If this goal is not achieved, the company will eventually die.

The price setting, negotiation and contract review processes are therefore, vital for any company. What can go wrong if we fail on those processes? Let’s see some cases and you can rate yourself the risk severity:

- Product requirements. If the company ABCD calculates and offers a “good” price based on the documents of the customer and states “feasibility confirmed”, the company is contractually accepting to deliver the product as the customer wants. But what if some tolerances, materials or validation tests were not considered? What if due to “an omission”, the fulfillment of requirements makes the manufacturing cost go up in 25%? How can you request a price increase to compensate an omission?

- What if a car was planned to be produced in two different countries and 4 different plants and you only consider the sites close to your manufacturing facilities? The delivery cost could kill the profit you wanted to have.

- Design responsibility and liability. What if the OEM pays for the design and development of brand-new products and as per the SOR you take 100% of responsibility, accountability and liability. The customer fails to inform you that some of the peripheral components which work with your products were carry-over from old projects and are mandatory to use in your system. If you did not limit the scope and reach of the responsibilities and failed to communicate risks and DFMEA, you can be deemed liable in all cases. What if there were casualties or recalls?

- Cost and losses. If you miss an important condition or specification in the technical or any other customer requirements and you accept and SIGN the contract, your customer can make you comply at your own cost and losses. Even if you could win a legal case against an OEM (and correct your omission) you would never be considered again for future business.

I would then recommend preventing problems in the first place. In this industry is a standard to establish and strictly attach to a pricing procedure, contract review, sales process or any of your own-created-processes which enables you to properly:

- Confirm manufacturing feasibility which considers ALL customer requirements

- calculate a price ONLY when you are sure to attain conformity,

- fulfill all customer and legal requirements

- estimate risks and opportunities

- make profit

If you already have such a process, this post may not be too relevant for you but, if you do not have yet such a process, this post might give you some valuable hints!!!

The entrance ticket.

For a company who is willing to enter into the automotive market and to be consider a potential supplier (by ABCD for example), it is required (depending on the car maker needs and systems):

- A certified quality management system (IATF16949),

- Fulfillment of CSR (customer specific requirements which are additional quality system, requirements on top of those stated in the IATF),

- To be assessed and rated as a capable potential supplier. Most of the OEM’s have processes which include technical reviews, audits, RFQ (request for quotation -for pricing reference only-), risk analysis, financial ratings, etc.

- Technical capabilities which can provide the OEM with a competitive advantage. This includes a product portfolio and elements of research and development or/and project management.

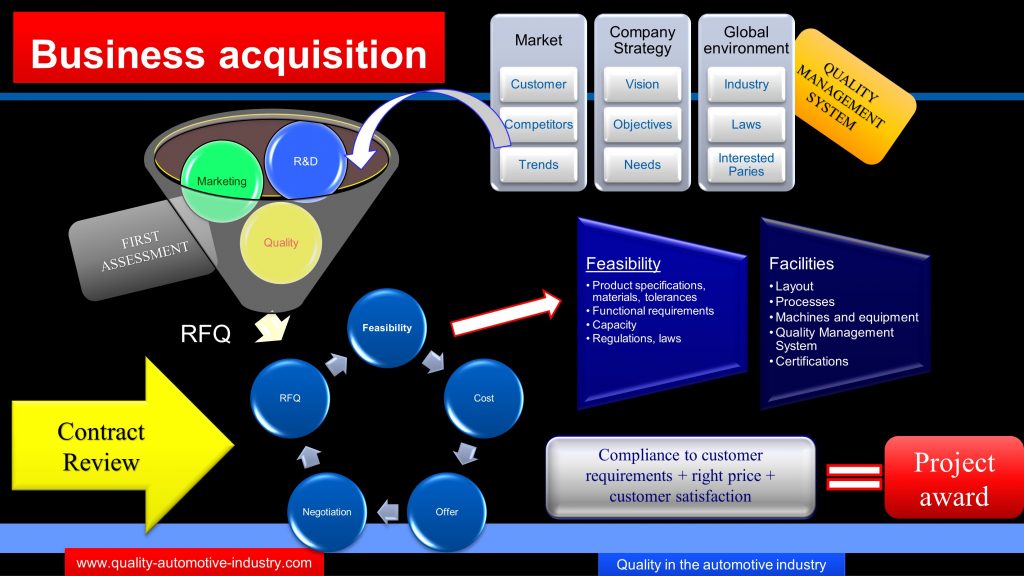

Once the OEM is satisfied with the results, the supplier may be including in “biding packages” and gets the entrance ticket to potentially be awarded a project. You can take a look at the image below. So, the business acquisition may now be possible.

OEM Supplier selection process.

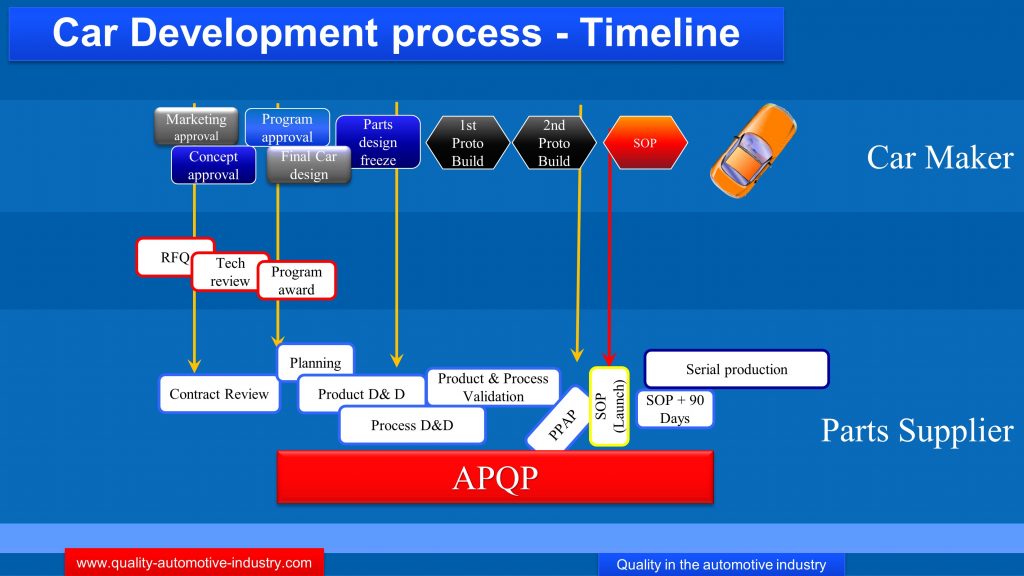

The overall car development process was covered in the post APQP but, as a little reminder please take a look at the image below. We will focus on the RFQ (as part of the OEM activities) and the Contract review (as main activity of the automotive part supplier).

The Original Equipment Manufacturer or Carmaker, normally provides a complete and extensive information package along with the RFQ (request for quotation) including all important and CONTRACTUAL requirements to be fulfilled, normally called SOR or statement of requirements (listed here below as input). The expected response is not only the corresponding price of the products but the confirmation of manufacturing feasibility and related conditions (listed here below as outputs).

RFQ + SOR & Price Offer + Feasibility

Contract Review

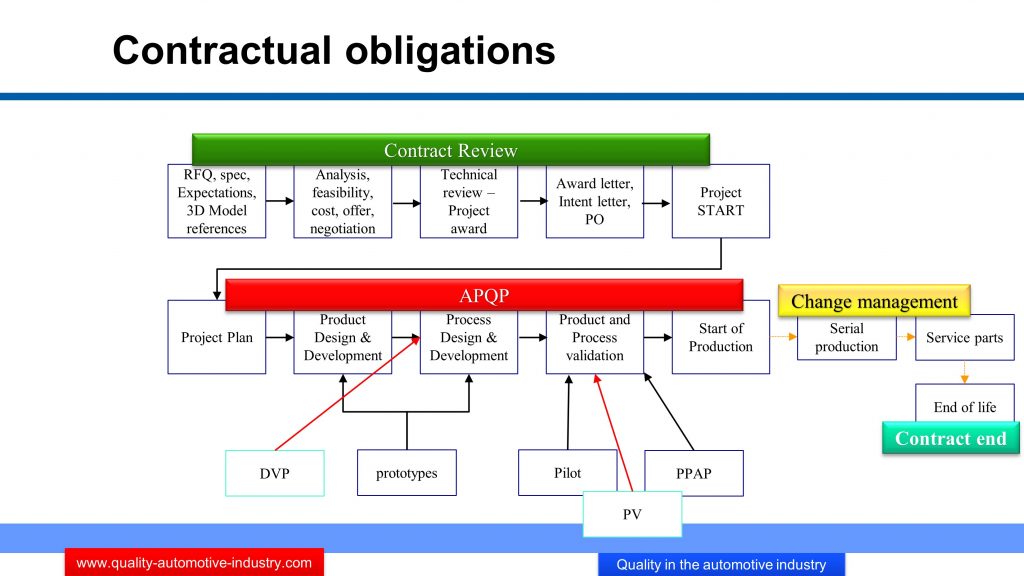

The easiest way to describe what the contract review is could be: a systematic process to address the customer price request to minimize risk and to ensure feasible and acceptable conditions for the related parts. Please note that the process starts with the RFQ and, if the project is awarded and a purchase order is received, the contract will prevail and live until the related car model dies. The end of life takes place normally ten years after the serial production has stopped and you are supposed to deliver service parts until the end of life is official. This image describes better the reach of an automotive contract and the phases:

– RFQ & Pricing. This phase ends with the project award. Sets the frame of the contract, technical requirements, related price, etc.

– APQP. Once the project has been awarded, the product will be developed to guarantee a successful launch.

– Serial production. Depending on the carmaker and model the serial production is carried out between 5 to 7 years (but some models have even exceeded 20 years like the VW bug or Nissan Tsuru in Mexico). If conditions change or the OEM needs technical modifications of parts the change management process should be executed.

– Service parts delivery. As we mentioned before, this covers the “road life” of the car and depending of the OEM could be 10 – 15 years.

– End of life. When you officially get in black and white EOL notice, you can then dispose of the production tools, parts in inventory, etc. Please note that the OEM may set conditions for tool destruction and disposal.

So, in general, the contract review takes place from the RFQ through the EOL as you can see in the next image

Sales Process as part of your QMS

In my experience of more than 23 years in the automotive industry I have been around 15 in sales and project management (or product development) and the rest in quality. In most of the companies i have worked for, there have been products relevant to safety like glass and seats. Therefore it has been for me very important to define robust processes and to work accordingly.

Whenever we open a new facility we had to establish the quality management system and train the new employees. As you may already know from your company or from the ISO9001 requirements, a SIPOC is a very simple graphical process flow that can help show the main activities in a process and the relationships with all other business processes.

For the sales professionals and due to the complexity of customer requirements, contracts, liability and all other topics covered in this post, we defined the following sipoc. Take a look and if you find it useful, implement it and stick to it. It can help you balance the legal power of the OEM and minimize risks. Besides, when well executed, you cover many of the IATF16949 requirements.

If you liked this post, subscribe and send me your information requests and comments.

Regards

Miguel

0 Comments